Top 10 wholesale trends to follow in 2026

Explore the wholesale trends shaping 2026, focusing on stability, strategic partnerships, brand identity, and digital transformation to drive sustainable growth in B2B eCommerce.

Wholesale isn’t just a “back channel” but a data-powered engine that drives the world of global commerce. And brands are taking notice. They’ve moved away from the disruptive strategies that once defined the industry to adopt a calmer, more deliberate approach for the year ahead. Fast growth is out, and prioritizing all things steady and sustainable is in, including healthy margins, reliable partners, and smoother operations.

This significant shift reflects a great desire for stability. The industry has faced many unknowns and quick, surprising shifts, and wholesale offers solid ground, diverse revenue streams, less risk, co-marketing opportunities and more. Still, chasing trends doesn’t have to be a bad thing; businesses always bend to grow and it can help you stay agile. The top 10 wholesale trends to follow in 2026 perfectly reflect this new mindset.

Read on to observe how these trends mirror brands’ current approach to business and to catch a glimpse of where this momentum is heading.

Trend 1: Stability is the new definition of growth

In the 2025 edition of our annual wholesale report, we witnessed stability take center stage. After surveying 103 NuORDER customers and brands, we discovered brands are as growth-minded as ever, but they’re replacing high-risk strategies for moves that offer sustained success over a long period of time. Faced with unpredictability and pressures outside of their control, they’re fortifying their businesses to ensure they can remain strong and steady over time.

So what matters most in 2026? Consistency, predictability, and profit. That’s why this shift in dynamics gives wholesale a significant role. In pricing, that looks like prioritizing contract-based and static pricing over complex, market-responsive models. In fact, in our wholesale report we discovered 52% of surveyed brands prefer fixed pricing, while only 17% regard dynamic pricing as an essential.

2025 State of B2B eCommerce Report

With wholesale, brands can reap the benefits of higher, more reliable order volumes with a slightly lower or more predictable acquisition cost. What’s more, by selling wholesale strategically, brands can enter multiple regions without needing to localize their efforts for every market. Wholesale also doesn’t have the volatility of other channels, such as direct-to-consumer eCommerce (DTC), influencer marketing, and social commerce. It doesn’t replace other channels but creates a solid pillar designed for longevity and steady returns.

Trend 2: Brands are choosing better retail partners, not more of them

Since brands are deploying more temperate strategies in 2026, quality far outweighs quantity. It’s as if, in the quiet of steady growth, the industry has become far more aware of which retailers they partner with and why.

Findings in our 2025 Retail Insights Report, “The Age of Intelligent Buying”, support this shift. The report offers findings from our survey of 60 merchants (director level or above) employed by enterprise retailers, department stores, and big-box retailers with $50 million or more in annual revenue. Their responses show reliability and brand alignment continue to be essential when it comes to strategic partnerships (28% and 35% of respondents, respectively). However, merchants are increasingly prioritizing product differentiation (18%) and deeper consumer insights (17%) too.

Thus, brands can become more desirable partners by developing standout product and offering data and other proof points to help retailers satisfy market demand. Partners like these help retailers reduce risk, capture demand, and sustain healthy profitability.

Savvy companies are investing their energy into retailers that understand their brand, protect their pricing, and value the power of true collaboration. These retailers also really understand the end consumer well—and it shows through their strong, local communities and expertly-tailored assortments.

In any era of wholesale, strong relationships with buyers is a must. They often lead to better outcomes for both parties, including higher sell-through rates and longer-term, steadier success.

Brands, here are a few ways you can stand out as a valued partner:

- Make it easy for retailers to replenish orders and place in-season buys

- Be transparent about product performance and feedback

- Send personalized, suggested buys based on retailers’ order histories and interests

- Stay in touch throughout the year—don’t wait for market weeks and appointments

- Offer self-service access to essential data and insights

Trend 3: Extending control beyond the handoff for stronger brand identity

Since content and excellent storytelling have become increasingly important, it’s no longer enough to simply hand off your brand guide and supplementary materials to retailers. While the potential for valuable co-marketing has always been one of the benefits of wholesale, today’s brands recognize retailers as the co-storytellers they are—especially in digital channels. As a result, brands are giving retailers richer content, stronger images, detailed product attributes, direction for curated assortments, and clearer cross-channel alignment. This increases allure while ensuring everything customers see online and in stores reflect a unified brand story.

And since retailers are being more selective, investing in fewer brands, it presents the opportunity to engage in more thoughtful education. Brand reps are meeting with retailers (virtually, at buying appointments, and even in stores) to teach them about their products, especially technical SKUs. As a result, store-level associates, eCommerce managers, and eCommerce marketers know exactly how to pitch their products in the most interesting and relevant ways to shoppers.

And it’s a mutually beneficial shift; brands are reducing friction for retailers while further enhancing the customer experience. Powerful storytelling is also a must-have for both retailers and brands. The right storytelling creates greater differentiation among brands, increases loyalty, and can help increase community support, such as word of mouth. When brands support retailers to offer richer storytelling and brand experiences, it leads to better conversion and wholesale growth with the power to scale.

Source: Samsøe Samsøe

Trend 4: MSRP still wins, but flexibility has its place

Brands are continuing to price strategically, especially in unpredictable markets. They’re prioritizing MSRP discipline and full-price integrity while resisting the old allures of discount culture. In this period of sustainable, steady growth, flexibility still plays a role but it’s showing up in assortment strategies, rather than constant changes in price.

Specifically, many brands are offering a mix of core, value, seasonal, and limited-edition styles to serve the needs of different consumers and for the same consumers at different times. It’s a great way to offer a diverse range of prices without relying on markdowns. This emphasis on value over discounting fosters brand loyalty, protects margins, reshapes consumer behavior, and protects brand integrity.

Trend 5: Supply chain resilience built through relationships

After seasons of disruption, fluctuating costs, and substantial unknowns, the industry is protecting supply chains from the roots of their foundations: relationships. When shipping routes need to change, when logistics are under pressure, whenever there are cost fluctuations, delays, or shifts in demand, brands know their ability to maintain operations and thrive will always come down to their relationships. As a result, instead of redesigning their supply chains from scratch, they’re consciously focusing on strengthening relationships with their existing suppliers.

And it’s a two-way street; standing matters. Retailers should prioritize paying vendors on time and communicating quickly and effectively. This builds trust but it also helps brands move with greater agility.

What else can be done?

- Offer supply chain transparency

- Diversify suppliers

- Share contingency plans for changes in shipping routes due to factors such as climate events

- Invest in demand forecasting technology

- Leverage inventory optimization technology

When brands and suppliers collaborate as partners, they’re more likely to be able to keep product moving when plans change. They work together to improve forecasting and to create increasingly effective contingency plans for the previously mentioned detours, delays, and surprises. In 2026, it’s less about perfect operational execution and more about having the right amount of visibility, communication, flexibility, and rapport to be able to adapt quickly.

Trend 6: Integration-powered digital transformations

There’s less room for error in a rapidly evolving macroenvironment. However, while most brands have invested in adding various digital tools to their tech stacks, the unfortunate truth is that some are unable to work together smoothly. When that’s the case, brands lose crucial visibility and real-time access; they also run the risk of referencing inaccurate data. The result is slower, clunkier operations and the need to rely on manual processes to make it all make sense. Not only does this strain teams but it also opens the door to the potential for human error.

What are the most important areas for integration?

- Product information

- Live inventory status

- Pricing information

- Customer information

- Order status and order changes

- Shipping updates

Benefits of integration

- Reduces costs associated with selling wholesale

- Improves sell-through

- Limits costs associated with customer service

- Optimizes production

In 2026 and beyond, streamlined, two-way sync operations across platforms need to be non-negotiable. Brands with fully integrated, fully operational tech stacks enjoy less friction, far more accurate customer, product, and sales data, and the ability to make faster, more confident decisions in wholesale—all culminating in the ability to increase profitability (the key to stable growth).

Trend 7: B2B eCommerce grows beyond basic ordering

Once regarded as a simple tool for placing basic orders, brands have come to recognize the power of having the right B2B eCommerce platform to make far more strategic moves. Brands are choosing more sophisticated platforms to support reorders and in-season selling, to improve the performance across accounts, and to streamline the operations of their sales teams. They want real-time access to vital information to ensure real-time inventory management is simply par for the course; they know they don’t have to oversell or undersell because of data discrepancies.

And imagine the advantages you can gain when you can quickly identify the season’s top-performing, high-margin SKUs as a team, as illustrated by Lightspeed’s newest retail survey of over 350 shoppers, “Inside the Minds of Customers”. Getting so much more out of the heart of their wholesale tech stacks is directly helping brands and retailers become a lot more profitable. POS integrations are also making it possible for retailers to merchandise quickly after placing their buys.

“Previously, everything was on paper, and we’d have to dig through folders or hunt in someone’s office. Now, from home or anywhere, I can log in, pull up the details and instantly access all the information.”

—Steffanie Evans, Owner, Rutherford’s Design

Adopting a powerful and convenient B2B eCommerce platform is no longer a nice-to-have. Retailers have come to expect to be able to browse and order from every brand they stock in their stores from a single digital hub. And as retailers become more comfortable with navigating surprises in the market, it’s never been more important to be able to quickly order replenishments, immediates, and seasonless SKUs all year long.

Trend 8: Sell-through becomes a shared focus

As selling throughout the seasons has become more essential and more commonplace, post-season sell-through metrics are no longer enough. Brands and retailers need regular access to real-time sell-through rates and insights to spot what’s working, what’s not, and to catch on to emerging trends. For example, many stores have started asking consumers for detailed feedback about their returns. They want to know if returns were inspired by fit, quality, inaccurate representations of color, damage, or other contributing factors. Retailers have this data, and they should (ideally) be sharing this with brands to provide real, actionable performance feedback so they can improve future sell-through as a team.

Brands and retailers are also strategizing in tandem to develop better-selling assortments. Retailers used to focus on buying bestselling items, but with this shift, brands can sell far more SKUs. Together, they can put a lot more thought and experience into identifying what will likely resonate and sell.

Retailers and brands collaborate best when they share the same definitions of success and adhere to the same timeframes for reorders, assortment adjustments, and in-season support. What’s more, the more both parties know about what’s selling, where, to whom, and why, the more likely they’ll be able to anticipate style preferences, effective strategies for localization, and demand for future, continued success.

Strategic brand-retailer partnerships build trust, reduce friction, and keep everyone focused on improving performance as a collaborative effort.

Trend 9: AI adoption remains practical and purpose-driven

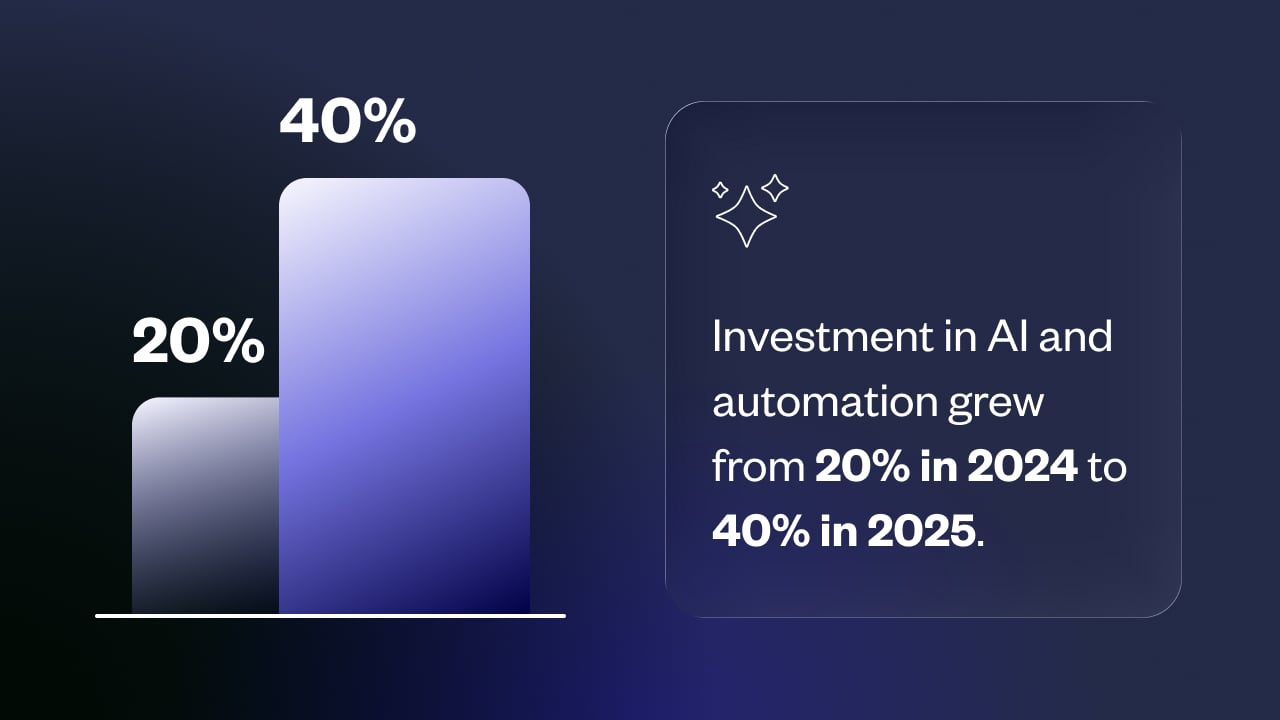

For many retailers, AI is anything but a futuristic concept; they’re already using it every day. Brands are taking notice, applying AI in very practical ways as a start. For example, brands are automating routine tasks and improving forecasting. They’re also using AI to place data at the forefront of their decisions to take action with greater speed. For instance, intuition still plays a role, but now brands are using it as a supplement to quantitative data, predictive analytics, and AI-powered forecasts. AI is also playing a major role in generating marketing materials with speed: color mockups, styled samples, flatlays, and more; this leads to faster sell-in and fewer production delays.

According to our 2025 Retail Insights Report, 40% of respondents say their enterprise retail employers are investing in AI and automation—up from 20% in 2024. Brands that use AI in 2026 will be well-positioned to keep up with the pace of AI-deploying retailers. They’ll also be able to use AI collaboratively to stay aligned.

2025 Retail Insights Report

Trend 10: Product data becomes a quiet driver of sell-through

Rich, accurate product data has been an underappreciated driver of better wholesale performance for far too long. Retailers can merchandise with greater confidence and reduce downstream issues (e.g., returns or missed sales) when they have access to detailed product images, sizing and fit information, material and fabric information, and other key product attributes.

This only becomes more important when it comes to cross-border wholesale. Clear sizing data and conversions lead to fewer broken sizes, and thus fewer stock gaps and lower return rates. Of course, this reduces costs and simplifies operations for both retailers and brands, but it also goes far in preserving brand image and integrity.

Smart brands make things easy for retailers so they can place better-informed buys—and be knowledgeable enough about each SKU to successfully entice shoppers to buy. In 2026, brands that treat product data as a strategic asset will see higher sell-through rates (across both eCommerce and brick-and-mortar environments) and more successful relationships with retailers.

What this means for wholesale in 2026

As brands focus less on rapid expansion and more on stability, profitability, and control, wholesale is becoming incredibly strategic. This strategic role will be supported by stronger partnerships, better integrations, higher-quality data, and far more practical uses of technology, including AI.

Brands, it’s time to see wholesale as the reliable pillar it is—one that supports your revenue and growth today while extending opportunities to adapt and evolve as external factors change.

Related articles

Get on the list

Wholesale tips and industry news you can’t miss, delivered weekly