Inventory Management - Production Forecasting Best Practices Part 2

You've formulated a demand forecast you're comfortable with and it's time to plan how you will meet this anticipated demand. Learn about inventory management here.

Production Forecasting Best Practices Part 2

In part one of Inventory Management: Production Forecasting Best Practices, we talked about using the bottom-up approach and pre-lining as integral aspects of your forecasting strategy.

In part two, we speak with field experts about:

- How to meet demand

- When to over-order

Meeting demand, minimums and ship dates

We previously discussed forecasting product demand. Now that you have a forecast you are comfortable with, it’s time to plan how you will meet this anticipated demand. The goal, of course, is to provide buyers with the product they need when they need it without getting stuck with excess inventory.

Meeting product demand requires you to meet your production minimums and to submit your orders to your manufacturers on time. Missing deadlines can leave you oversold and out of luck.

Imagine the frustration of dropping a style due to perceived lack of demand, yet your buyers placed orders for that style and are expecting it to arrive.

Managers should stay on top of their sales reps to ensure they get their orders in on time. There are countless nightmare stories of styles being dropped because the minimum order numbers were not met.

Meanwhile, the orders were placed with the reps, but they failed to submit them by the deadline.

Imagine the frustration of dropping a style due to perceived lack of demand, yet your buyers placed orders for that style and are expecting it to arrive.

Using a robust B2B eCommerce platform can help put a stop to such fiascos.

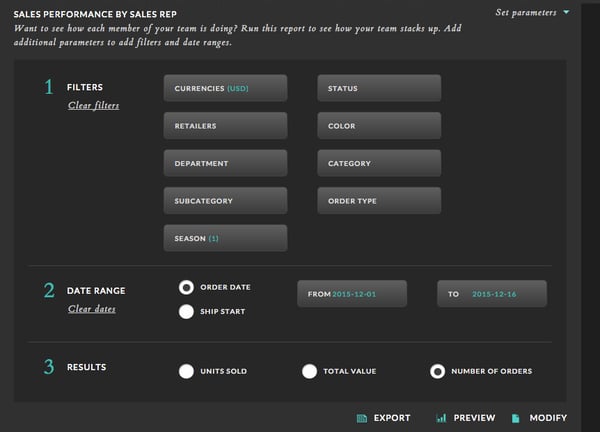

For example, NuORDER users with Admin rights can use the Reporting feature to filter by sales reps’ performance and use the parameters to filter to see which reps have submitted their orders by a specific date:

Filter by sales rep, order date and order quantity to ensure reps submit orders by a deadline

Filter by sales rep, order date and order quantity to ensure reps submit orders by a deadline

SMUs

Special attention needs to be given to Special Make-Ups or SMUs, items produced specially for certain large stores, because they often have large production runs and need to be submitted earlier than usual to ensure ship dates are met.

Mike Reola from Lost Enterprises reiterates this point: “For SMU buys, it’s imperative that we show them (buyers) the product early and get the order so we can push our manufacturers for quick production."

Ship dates

Seasoned sales forecaster and marketing manager Matt Keenan offers advice to those who may be new to the wholesale apparel, shoe and accessories business and are strategizing to meet minimums and ship dates:

“Some smaller brands might even break their product offerings into three seasons instead of four when starting out. The break-out could be a spring / summer / fall season and then add a later ship date or two in fall to cover holiday. Another strategy could be to combine spring and summer and break out the ship dates there.”

“Some smaller (apparel, shoe and accessories) brands might even break their product offerings into three seasons instead of four when starting out.”

– Matt Keenan, Sales Forecaster / Marketing Manager

Relation-ship-dates

Meeting ship dates can also be reliant upon your relationships. Sara Jackson, Director of Retail Relations at Deny Designs, suggests brands “find great suppliers with quick turnaround, so you don’t have to invest in unproven products.”

“Find great suppliers with quick turnaround, so you don’t have to invest in unproven products.”

- Sara Jackson, Deny Designs

Keep an eye or two on those dates

Managers can log in to their brand's B2B eCommerce platform to keep an eye (make it two — this is important) on upcoming ship dates for each buyer.

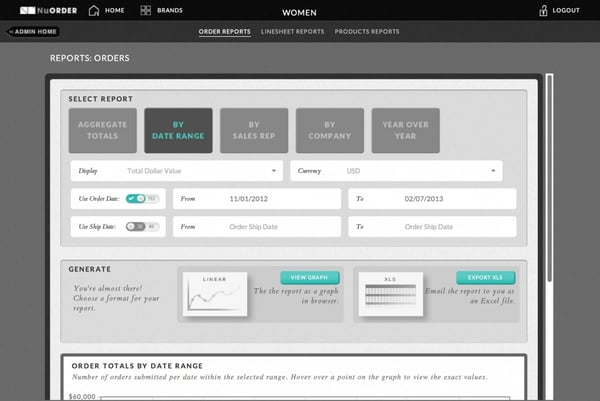

For example, NuORDER users are able to log in and Filter their Orders by Date Range to ensure they meet their ship dates:

Filter Order Reports by Date Range and Ship Dates to keep track of meeting your deadlines

Filter Order Reports by Date Range and Ship Dates to keep track of meeting your deadlines

Over-order with caution

Over-ordering should be limited to mature products with stable demand. For example, a surf brand producing wetsuits can reasonably expect to sell a certain amount of wetsuit boots during a coming winter. If there is an unusually cold winter predicted, a brand may choose to produce more boots than what they normally would expect to sell in anticipation of increased demand.

“Planning for a 5-8% variance is acceptable.”

– Rebecca Carlo, Lucky Brand

When it comes to considering over-ordering quantities, Carlo advises to err on the side of caution: “You can plan some ‘chase’ business for new customers, but first establish the demand off the current customer base. I would place the buys with the factories exactly as you planned. However, planning for a 5-8% variance is acceptable.”

All about that base (not bass)

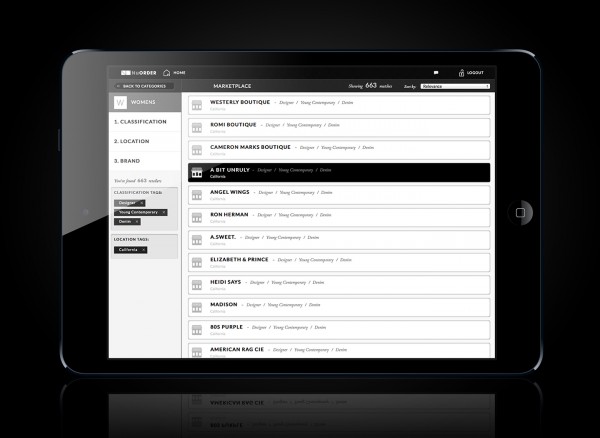

Want to increase your current customer base? Use your B2B eCommerce platform to do it.

For example, brands using NuORDER have access to a database of over 18,000 retailers. Users can Filter by Category and Location to browse retailers who fit their demographic. Brands can also Filter by retailers carrying their competitors. When a brand finds a retailer they would like to reach out to, they can click on the retailer and view their bio and contact info.

Filter your search by retailer type, product/brands they carry, or location

Filter your search by retailer type, product/brands they carry, or location

More base, please

Sara Jackson offers similar feedback about determining demand from the current customer base, stating “I recommend determining style performance before over-ordering and committing too many dollars to a particular piece.”

“I recommend determining style performance before over-ordering and committing too many dollars to a particular piece.”

- Sara Jackson, Deny Designs

Proven winners only

Mike Freihofer, industry stalwart and CEO of The Action Expo, also advises using past data: “If you are basing your (production amount) decision on a product style, it must be a proven winner. For instance, a brand such as Hurley knows their Phantom boardshort is a proven seller. For this type of carryover style with a multi-year track record, producing a little extra to accommodate in-season demand is reasonable.”

“If you are basing your (production amount) decision on a product style, it must be a proven winner.”

– Mike Freihofer, The Action Expo

Segment your product info

Using past sales information to help determine what might perform well in the future. Try to break down this information to help determine any trends.

Use your B2B eCommerce platform's Reporting feature to analyze the specifics of what has performed well in the past.

Carlo recommends filtering by the type of product and other details, such as color, style, size and any other details that pertain to your brand and industry, saying "After you get the total order volume, break down the business into segments.” She continues, “If it’s woven shirts, you can break it down by color, style, etc…"

"After you get the total order volume, break down the business into segments.”

– Rebbecca Carlo, Lucky Brand

Carlo offers further advice on what to do with this information: "Next, assign a percentage to each of these segments, based on current trends. For example, if blue wovens are 40% of your sales, but you only placed 30% of the receipts in them, you’ll want to plan them to be more than 40% — unless there is a valid reason for not planning according to current demand.”

Brands who manufacture

Lost Enterprises is in a unique position, as it is one of the few brands using outside manufacturers (for clothing), while locally manufacturing their own hard goods — surfboards — giving them much more control over production times.

In regards to the surfboards, Reola says, “We have to pre-book and then make sure we stock up in season, based on immediate feedback from surf shops for the best sellers, as many of them sell immediately.”

“We have to pre-book and then make sure we stock up in season, based on immediate feedback from surf shops for the best sellers, as many of them sell immediately.”

– Mike Reola, Lost Enterprises

Even when a brand has this level of control over their own manufacturing, there are inevitable wait times. For an artisan product like a surfboard, there are a limited number of people with the specialized knowledge to manufacture an item where quality control is top priority. According to Reola, “Shops lose out if they have to wait two months for another 5’10 V3 Rocket model (surfboards are specified by dimensions and model).”

A sales rep for a brand using a B2B eCommerce platform can see how quickly a store sold through particular styles during seasons and years prior and be able to provide the store buyer with educated advice when it's time to pre-book. Furthermore, the rep can log in anytime, anywhere to view real-time sales information, empowering her to immediately know when a shop sells its last 5'10 V3 Rocket (for example). She can then send the buyer an email with a visual reorder suggestion followed by a timely phone call.

Marks do get missed

Finally, it's important to remember that even the most-established brands sometimes miss the mark when attempting to forecast production.

Freihofer says, “For large brands, demand planning encompasses several departments, from rep forecasting and marketing to pre-lining. It’s never 100% accurate and sometimes established brands overshoot and other times they completely miss it.”

"It’s never 100% accurate and sometimes established brands overshoot and other times they completely miss it.”

– Mike Freihofer, The Action Expo

With the right information, proper planning and a little intuition, you’ll be the Weather Channel of production forecasting in no time.

Ready to take the leap from pen and paper to a B2B eCommerce platform for easier, more accurate forecasting, but having trouble convincing upper management?

Check out Overcoming 3 Common B2B eCommerce Obstacles for the ammo to fire back when they lob excuses at you.

Related articles

Get on the list

Wholesale tips and industry news you can’t miss, delivered weekly